|

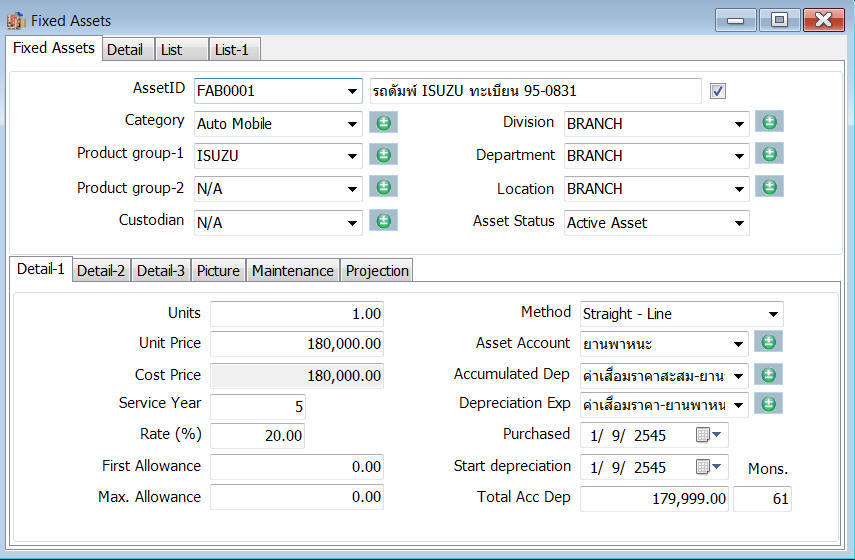

Asset

ID

|

It is the Asset ID. The maximum

length is 30 characters.

|

|

Description

|

The maximum length for description

is 100 characters.

|

|

Serial Number

|

The

maximum length is 30 characters.

|

|

Category

|

It is

just information field for grouping purpose. You may not

input it.

|

|

Brand

|

It is

just information field for grouping purpose. You may not

input it.

|

|

Division

|

It is

just information field for grouping purpose. You may not

input it.

|

|

Location

|

It is

just information field for grouping purpose. You may not

input it.

|

|

Department

|

It is

just information field for grouping purpose. You may not

input it.

|

|

Model

|

It is

just information field for grouping purpose. You may not

input it.

|

|

Detail

|

It is

indicate that there are list of detail on the Detail

tab.

|

|

Purchase Date

|

The

date that you purchased asset.

|

|

Document

|

It is

just information field for grouping purpose. You may not

input it.

|

|

Vendor

|

It is

just information field for grouping purpose. You may not

input it.

|

|

Accumulated dep.

|

It is

the account number that will be used for Accumulated

Depreciation. You must select it.

|

|

Depreciation Exp.

|

It is

the account number that will be used for Depreciation

Expense. You must select it.

|

|

Method

|

There are three options,

Straight Line, Declining and Write Off.

1. Straight Line is

the method that depreciates the value of an asset by a

fixed percentage every month until the value reduces to

zero or the salvage value.

2. Declining

Balance is

the method that depreciates the value of an asset by a

fixed percentage each year.

3. Sum-Of-the-Years is

the method that depreciates the value of an asset by

using sum of the service years as divider.

4. Write

Off is

an option used to expense the remaining book value of an

asset at the end of its useful life.

|

|

Unit

|

It is

the number of units.

|

|

Unit Price

|

It is

the unit price.

|

|

Cost

Price

|

It is the net price you paid for the

asset.

|

|

Rate

(%)

|

It is

the annual percentage rate of depreciation.

|

|

Next

Dep.

|

The value of next month’s

depreciation. |

|

Total

Acc. Dep

|

The

total amount of accumulated depreciation to date.

|

|

Book

Value

|

The

book value of the asset. If the asset is brand new, the

amount in the Book Value and Cost Price fields should be

the same.

|

|

Mons.

|

The

number of months has been depreciated so far.

|

|

Last

Posted

|

The

date of the last depreciation transaction.

|